Traditionally, a house is viewed as an asset. But is it? CBS MoneyWatch writers explain it best here:

“The house itself, the physical structure that you built or bought, is a depreciating asset, just like a car. It will age and fall apart over time unless you are constantly pumping money into it for maintenance. And the costs of maintenance and repair are expenses. Even when you pay off the mortgage, you will have costs to maintain, insure, and pay taxes on the value of that home. So, the bigger the physical house, the more it will cost you to keep it. That’s a fact.”

Finance gurus advise viewing your house as an expense or a declining asset that removes money from your pocket, especially once you retire and live on a fixed income. Without the potential for new income, the burden of insurance, taxes, maintenance, utilities, and more can be overwhelming and difficult to cover. Thus, the house becomes not only a declining asset but an unfunded liability.

Your House is an Unfunded Liability

Unfunded liabilities are debts without sufficient funds or other assets set aside to pay for them, according to experts. In other words, when you own a house (the debt) but you don’t own a pile of cash (sufficient funds) to pay for anything that goes wrong or needs improvement, or for insurance and other expected/unexpected costs. A historical example of an unfunded liability includes pension plans that a company knew they couldn’t cover with their existing assets.

Your house is also unfunded liability. Consider your retirement savings. Can you afford to remove a large chunk to pay for new plumbing or a new roof, and yet still retire and live comfortably? An even better question to ask is this: can your savings cover home maintenance, daily living expenses, plus your dreams for a vibrant, fulfilling retirement, AND an unexpected health event?

What Do You See and What Do You Want?

When you glance out your backdoor, what do you see? Perhaps, it’s an overgrown garden or that lawn set you never got around to refurbishing. Or maybe it’s acres of farm or ranch land that need to be mowed, trimmed, and cared for every day.

What you won’t is see a vibrant community offering a continuum of care for those days when you just can’t quite work up the motivation to mow the lawn or fix the step on the back porch that trips everyone up. You won’t see picnics with chef-prepared meals or an enthusiastic group of people dedicated to your well-being and life enrichment.

It’s an uncomfortable truth, but your house can become a freedom thief who requires constant maintenance and money as an unfunded liability and a declining asset. If you are yearning for freedom from house ownership and for peace of mind about your future care, it may be time to look at homeownership differently than you ever have before. Just like new Friendsview residents, Ken and Sue Pruitt did when considering their future.

“We were ready to be done with home maintenance and yard work and not having to worry about those things,” Ken says when asked why they chose senior living. “It gives us more time to pursue hobbies, various activities, and travel while we’re still young and healthy,” he adds.

Statistics show that older adults typically move into assisted living communities between 75 and 84. Life Plan Communities, such as Friendsview, are a little bit different. There’s a minimum age requirement of 62, and the residents tend to move in sooner to take full advantage of the vibrant living and wide range of amenities.

“We’re really happy that we moved in at this age,” Sue admits. “My parents lived at Friendsview for 15 years and we saw how much the caring, supportive community and all of the opportunities here affected their lives in such a meaningful way. We wanted that for ourselves.”

Many older adults want the same thing: a caring, supportive community that brings meaning into their lives and offers freedom from the responsibility of home maintenance and daily chores. But they also want peace of mind when it comes to future care. “Because of the continuing care model at Friendsview, we and our children will not have to make the difficult decisions about where we can get the care we need as we age or how to pay for it,” Sue shares.

A Life Care Contract Can be a Highly Refundable Guaranteed Investment that Outshines Owning a House

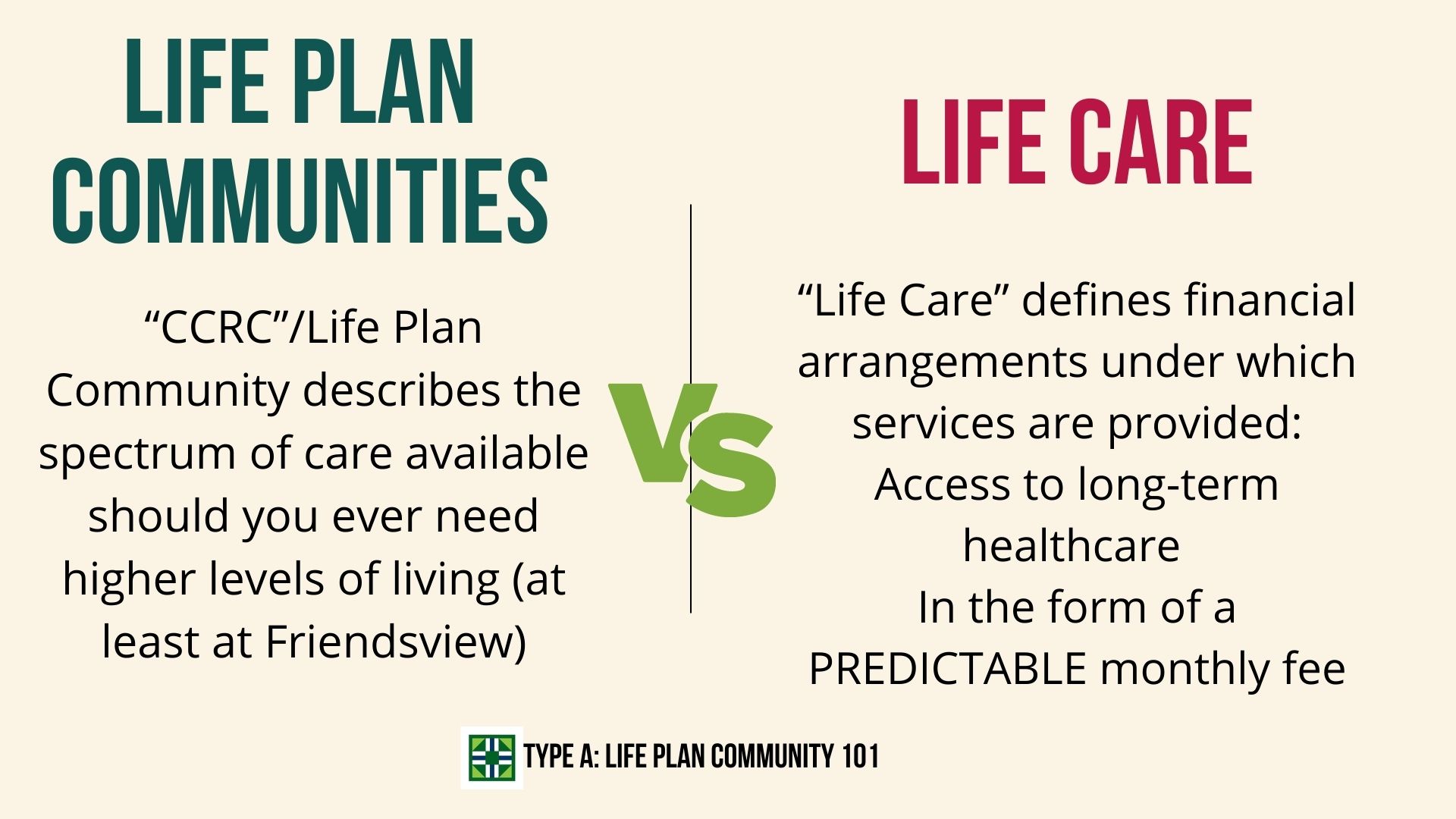

The mission of a Life Plan Community is your future care. Many of these communities, including Friendsview, provide a spectrum of care should you ever need higher levels of living.

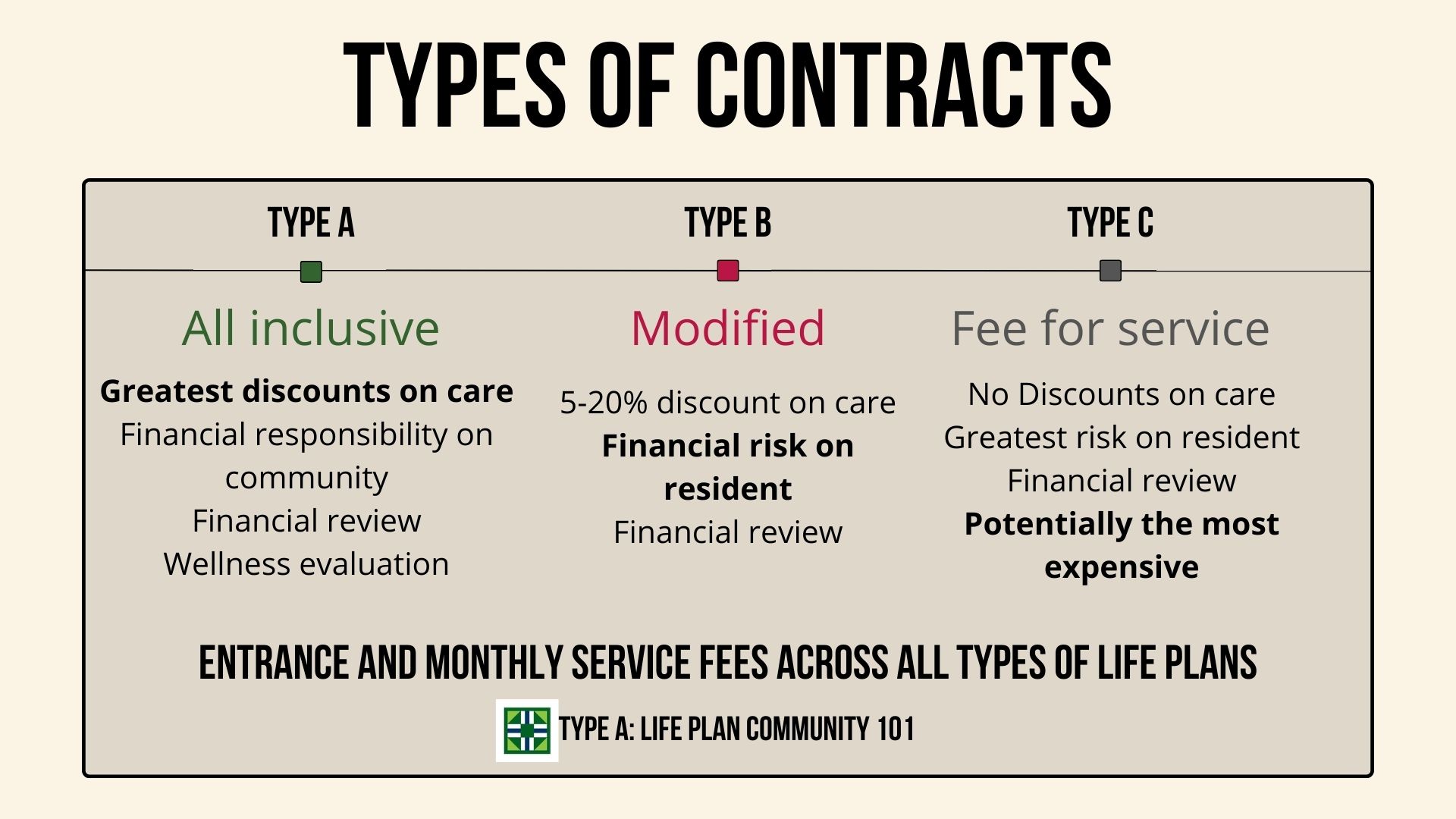

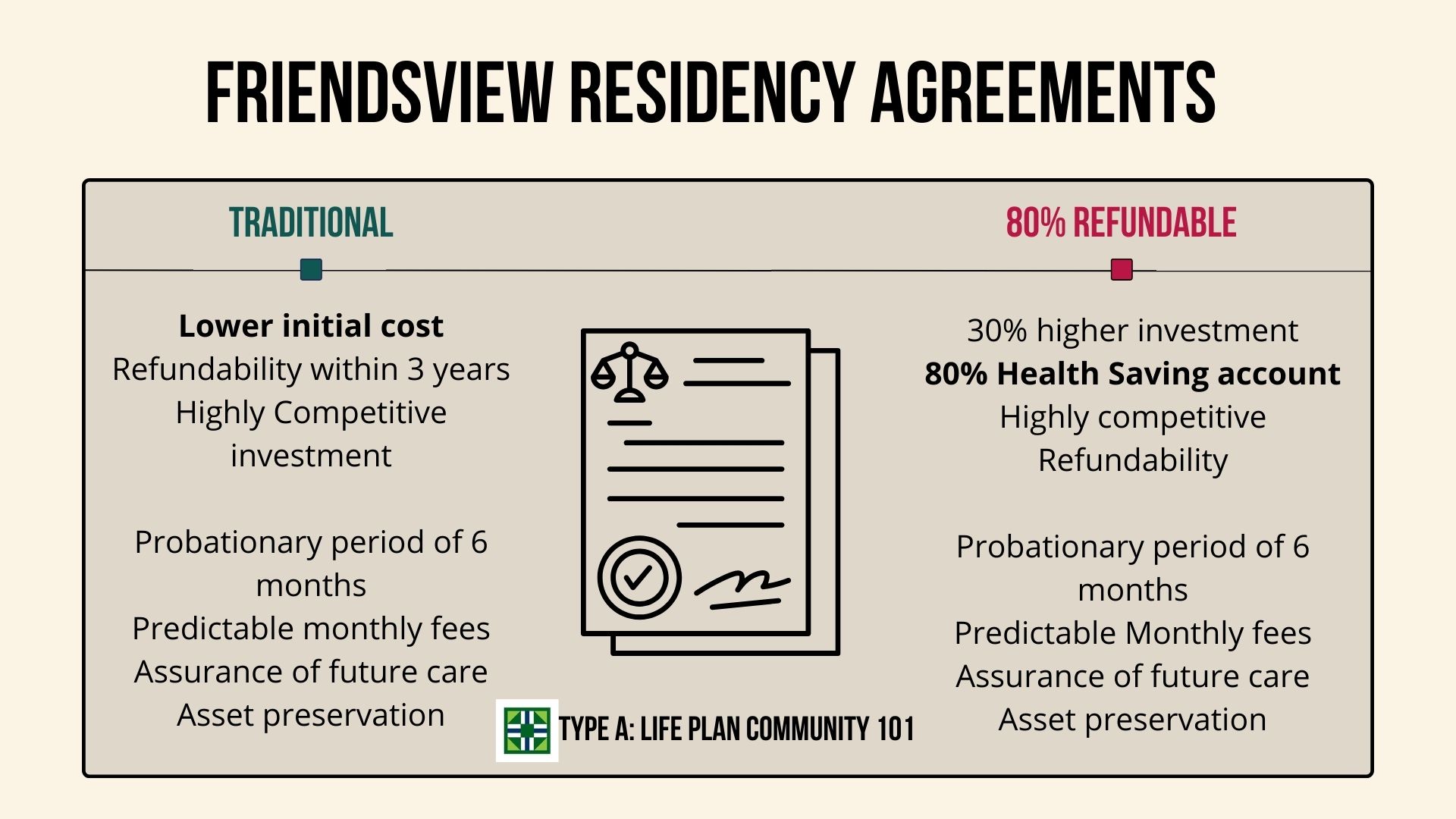

A Life Care Contract is a financial agreement between you and a Life Plan Community. There are several types of contracts with a wide range of possibilities. There are three main types of contracts: all-inclusive, modified benefits, and fee-for-service (see graphic). Each one has pros and cons depending on your individual circumstances. Communities that offer a Life Care Contract require an entrance fee that provides predictable monthly fees and the assurance of life-long continuing care. Friendsview also offers an 80% refundable agreement.

For a large population of seniors over the age of 62, an 80% refundable agreement alongside the assurance of future care far outshines owning a house. A house cannot guarantee someone will be there to provide care when it is needed. A house cannot provide peace of mind for your loved ones in the case of an emergency or a middle-of-the-night health event.

Your opportunities, freedom, and future care can be very limited when owning a house that is an unfunded liability and a declining asset. The housing market offers little guarantee as well. A fluctuating economy may seriously impact the value of a house from year to year.

Next Steps

Ken and Sue offer great advice for the next steps for those planning for their future.

“Move in while you’re young and can really enjoy all that a community has to offer. Tour several housing situations to see which best suits you. Talk to some current residents to hear about their experiences. Learn as much as you can about continuing care communities versus the possibility of reactive decision making.”

Reactive decision-making occurs when you experience an accident or health event and there is no plan in place, so you must react in the moment. If you require 24-hour nursing care, have you planned for someone to take care of the house, bills, and other daily life needs as well? No matter what your hope is for the future, a plan is needed. Not just a plan for one or two months, but for the next 5-10 years.

If you are not sure where to begin in creating a plan for your future, our Residency Planning Counselors would love to chat with you. Contact us today!

Questions to ponder:

- What’s your plan if something big goes wrong in your house (e.g., new roof needed, a flood, critter infestation)?

- Over the next five years, will you be able to continue with the upkeep of your house by yourself, or will you require the help of friends and family for basic home maintenance and chores?

- If your plan is to remain in your house, do your children have the capacity to become caregivers for the next 20 years or do you have the financial resources to pay for daily services?

- Think about your friends who are “succeeding” at late-life management. What are they doing differently than the ones struggling? What can you learn from them?